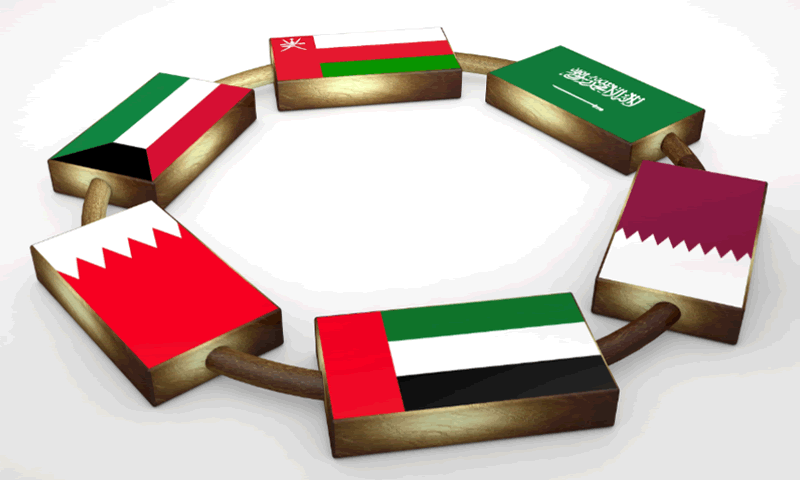

A recent report by BCG has highlighted the welcome news that – despite challenging times around the world – the GCC’s wealth is due to increase by 5.2% annually.

The report also predicts that by 2026 the region’s wealth will reach $3.5 trillion, up from $2.7 trillion in 2021.

Titled ‘Global Wealth 2022: Standing Still is Not an Option’, the report is good news for GCC countries’ economies. It states that the greatest asset class in the region is Equities & Investment funds, totalling 53% of personal wealth last year, followed by currency and deposits at 38%. Life insurance and pensions are expected to become the third largest asset class by 2026.

Despite accounting for only 2% of total personal wealth, bonds show the fastest rate of growth at a rate of 7.7% Compound Annual Growth.

Among the report’s other findings are that cryptocurrency is of great and growing interest, with almost 80% of clients interested in this kind of asset as long as it was accompanied by the correct advice and guidance from wealth managers – not currently seen as experts in this field.

Oil production has increased in the GCC countries, with the UAE reporting a Q1 rise of 12% in production year-on-year, and Saudi Arabia boasting a 19% increase over that same period. This is in tandem with an increase in oil prices.